Macro Signal strength #24

Global macro view of 30+ countries

This Content is intended for educational purposes only. No portion of this Content purports to be, individualized or specific investment advice and is not created to provide investment advice to individuals. All information provided is impersonal, general in nature and is made without regard to individual levels of sophistication or investment experience, investment preferences, objectives or risk parameters and without regard to the suitability of the Content for individuals or entities who may access it. No information found on this Newsletter, nor any Services provided, should be construed as an offer to sell, or a solicitation of an offer to buy any security or investment vehicle, nor should it be construed as tailored or specific to you, or any reader or consumer thereof. You understand and agree that this Content does not constitute specific recommendations of any particular investment, security, portfolio, transaction or strategy, nor does it recommend any specific course of action is suitable for any specific person or entity or group of persons or entities

The macro signal will examine the growth and inflation regime in the context of the market microstructure. That is, the data will not be monthly or quarterly, but daily and weekly. It is more of a high frequency approach given daily/weekly activity. By using machine learning and Bayesian inference, it is possible to get a pretty good signal out of large data sets.

What data goes into this regime classification? I try to put together a structure from all possible angles to account for the interactions between different variables. Every week the model gets retrained to keep up with the possibly of changing interactions between the data.

data groups:

commodities

interest rates

volatility

central banks

high frequency economic data

stock price movement

This is the basic structure of this analysis. So let’s start and have a look at the data.

2 Spotlights - market implied regimes

In this macro regime update we take another look at Brazil and show some additional information. For the updates, you will get India and also Brazil in detail. Both countries are currently signaling a strong long signal. This signal has been holding for 2 months now and remains strong. India is currently in reflation with a high probability of growth and a slightly higher probability of inflation. India is supported by macro signal strength, which is the stated measure of bullish price momentum with economic factors).

Spotlight: Brazil

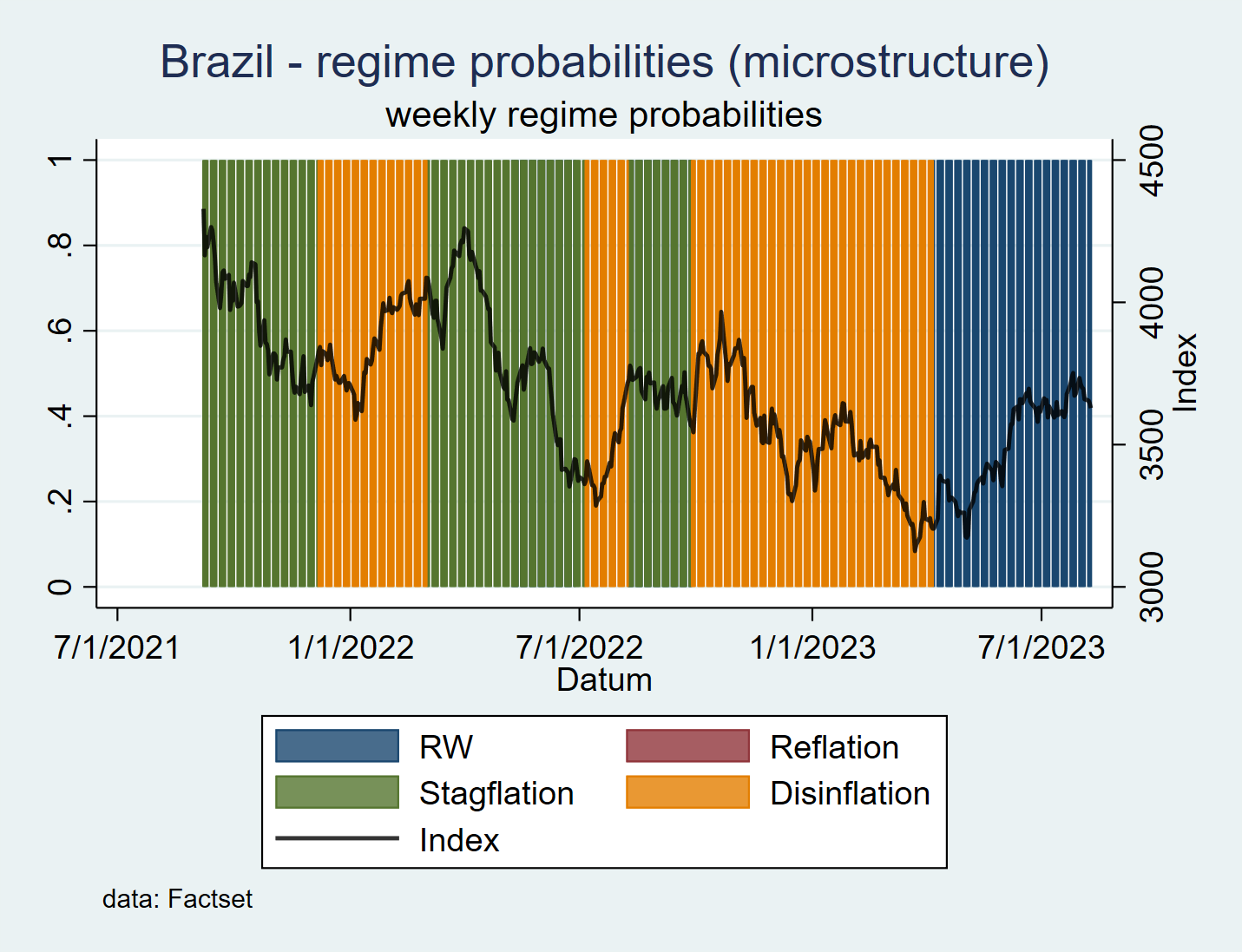

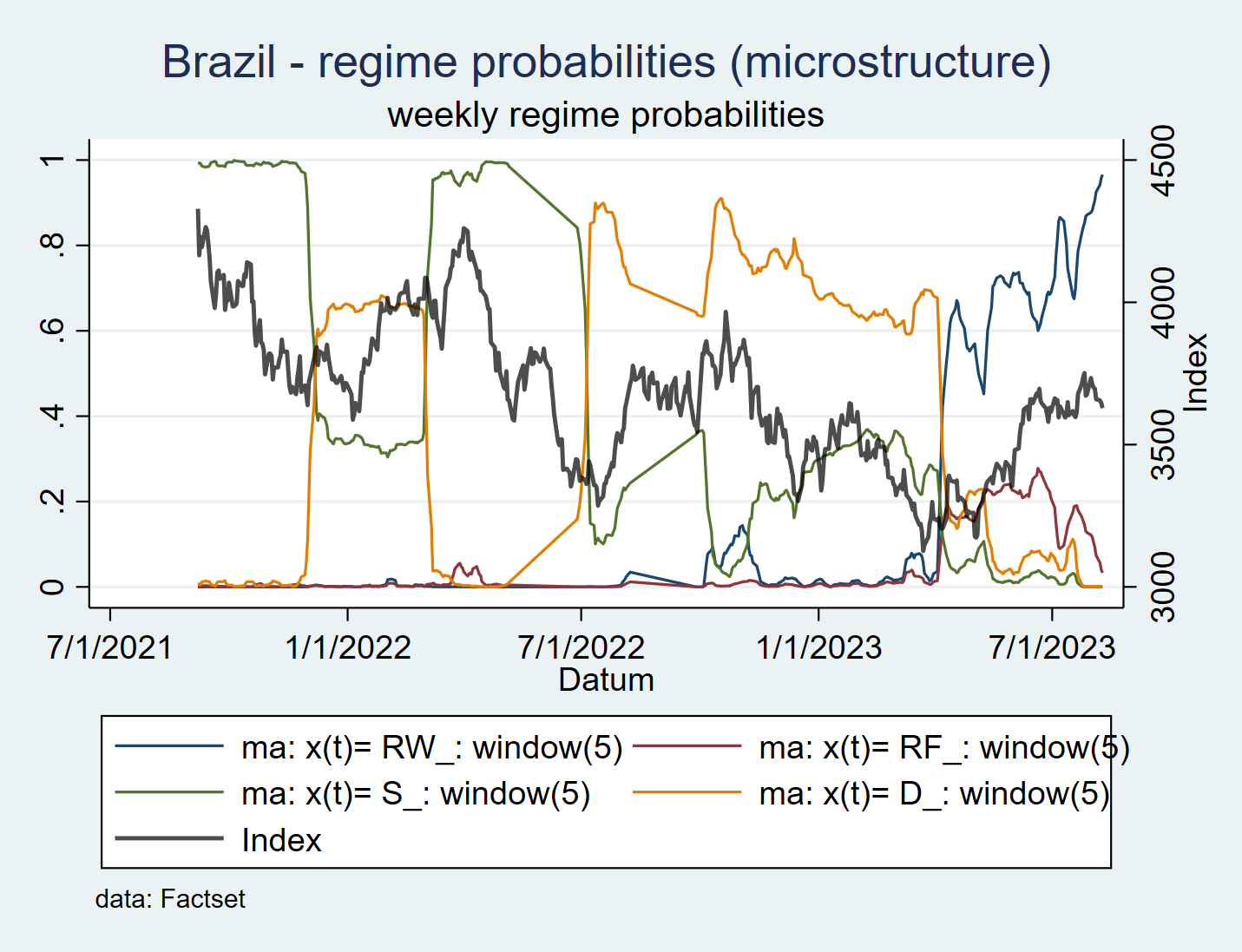

Brazil has been showing positive economic momentum for 2 months. The leading indicator is trending upward, as is the stock market index. Together with rising real growth, the stock index continues to show higher values.

Brazil weekly regime probabilities

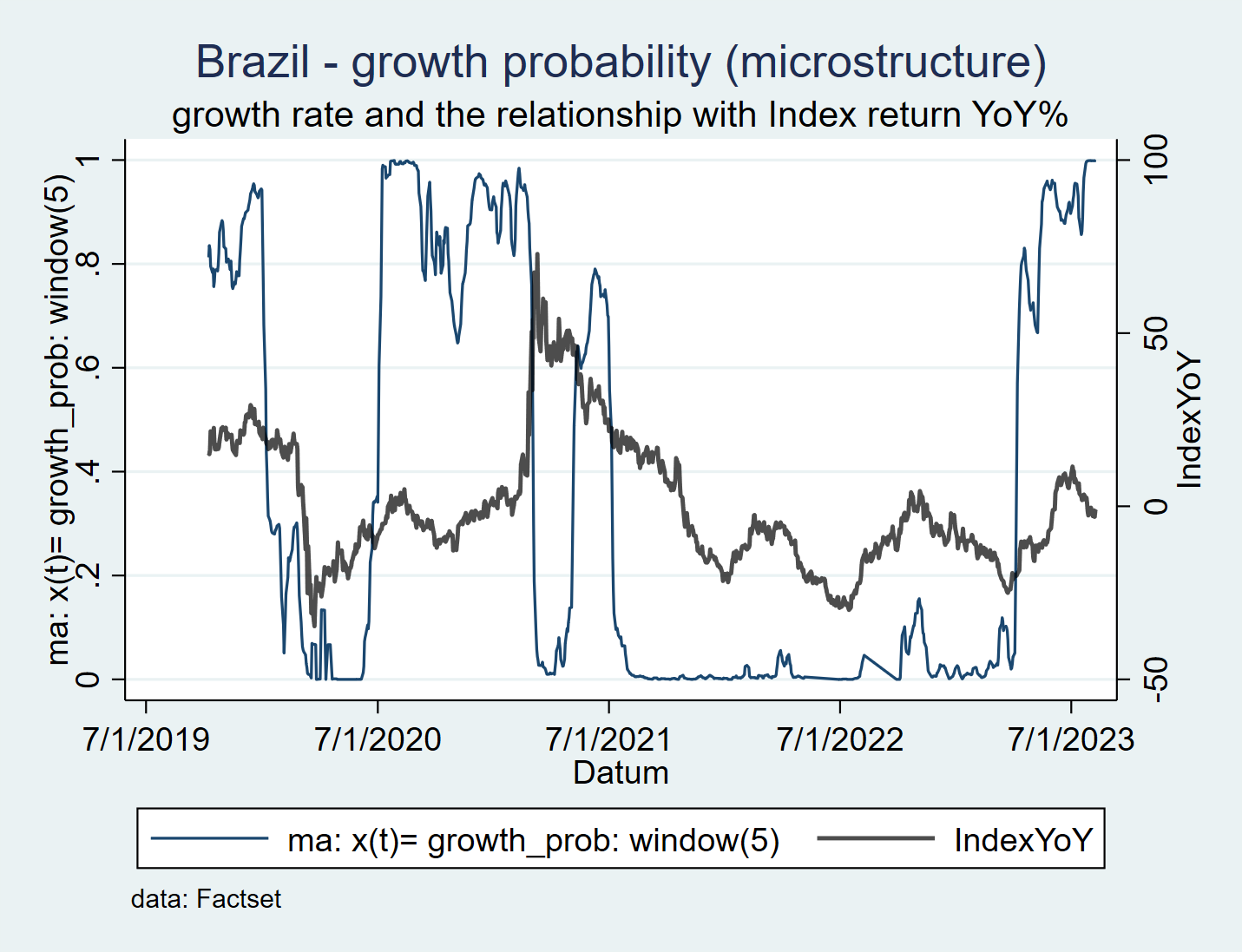

Brazil growth probability

After some time, the growth probability signals a regime change and approaches 100% probability. The last time this was achieved was after the Corona shock, when the country experienced a strong upswing due to strong governmental and monetary shocks.

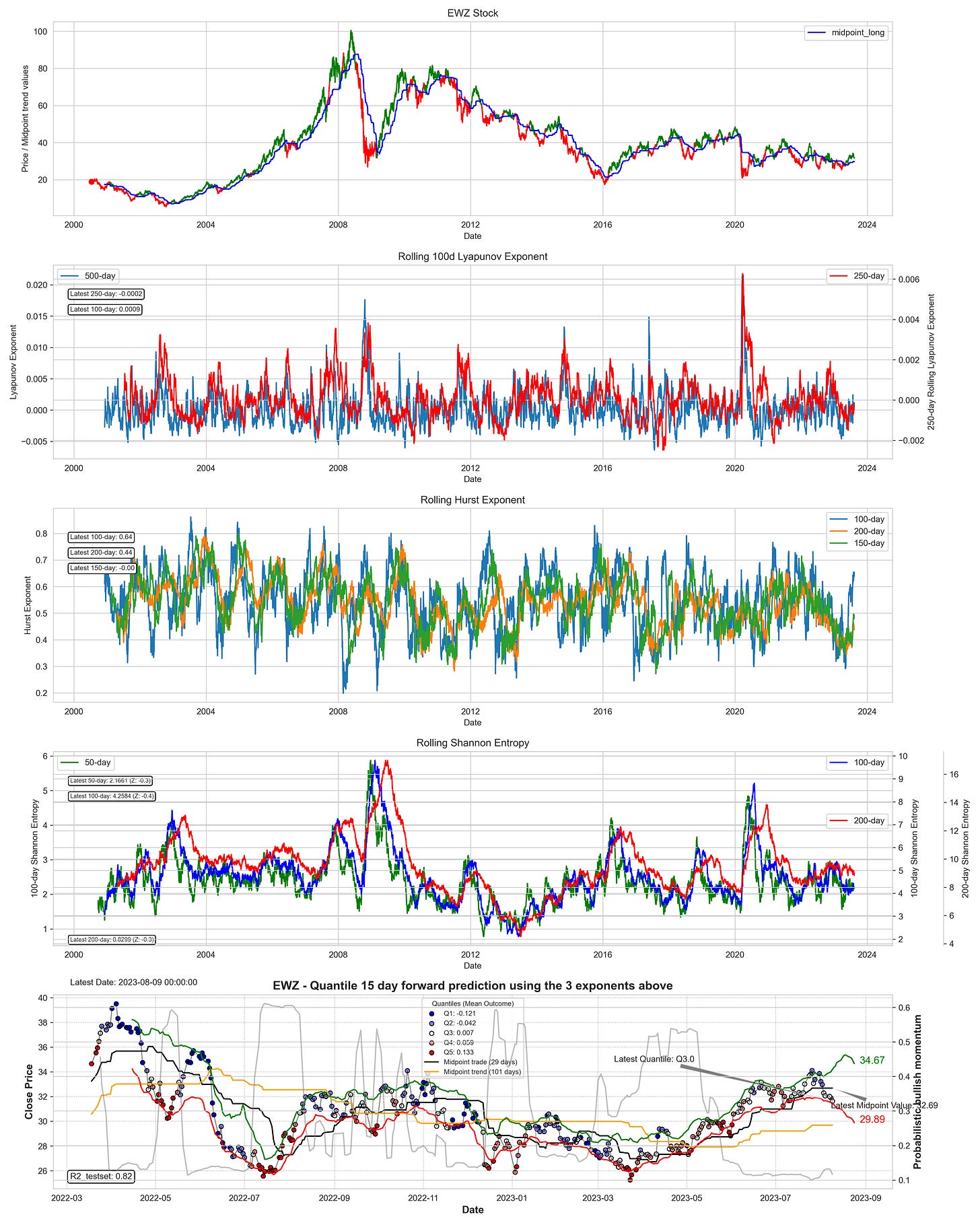

EWZ - ETF analysis

Below you can see the EWZ ETF, which recently went into upward mode, gaining over 10% in the last 6 months. Turning now to the model exponents, we see that the Hurst exponents are getting stronger and both averages are reaching higher values. The forward return model currently points to a quantile 3, which basically means 0% for the next 15 days. It is likely that the small correction will continue for a few more days.

Brazil - industrial production

Brazil's industrial production is now trending upward, especially the mining and quarrying subindex. It is always a positive signal for an economy when production in the manufacturing sector improves. Brazil is the second largest exporter of iron ore.

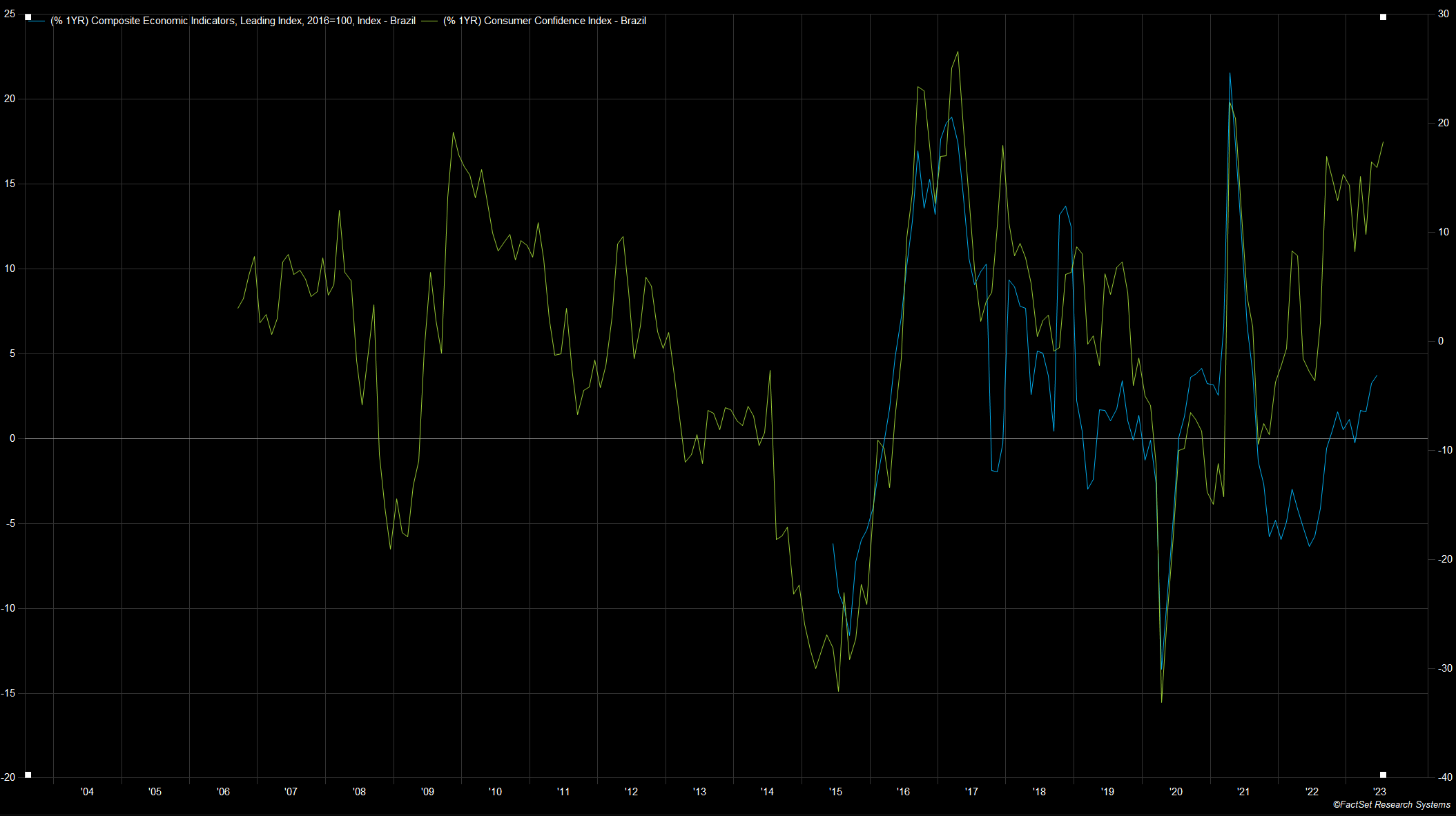

Brazil economic conditions

In addition to the positive trend in industrial production, we can also see that several survey data are improving. The leading index is improving, and the consumer confidence index is also recovering significantly from the lows of 2022.

Yearly coupon:

monthly coupon:

Below you can see the template, which represents the overview of the 30+ countries and is an essential part of the weekly analysis.

Global macro overview:

Keep reading with a 7-day free trial

Subscribe to This Time is Different to keep reading this post and get 7 days of free access to the full post archives.