This Content is intended for educational purposes only. No portion of this Content purports to be, individualized or specific investment advice and is not created to provide investment advice to individuals. All information provided is impersonal, general in nature and is made without regard to individual levels of sophistication or investment experience, investment preferences, objectives or risk parameters and without regard to the suitability of the Content for individuals or entities who may access it. No information found on this Newsletter, nor any Services provided, should be construed as an offer to sell, or a solicitation of an offer to buy any security or investment vehicle, nor should it be construed as tailored or specific to you, or any reader or consumer thereof. You understand and agree that this Content does not constitute specific recommendations of any particular investment, security, portfolio, transaction or strategy, nor does it recommend any specific course of action is suitable for any specific person or entity or group of persons or entities

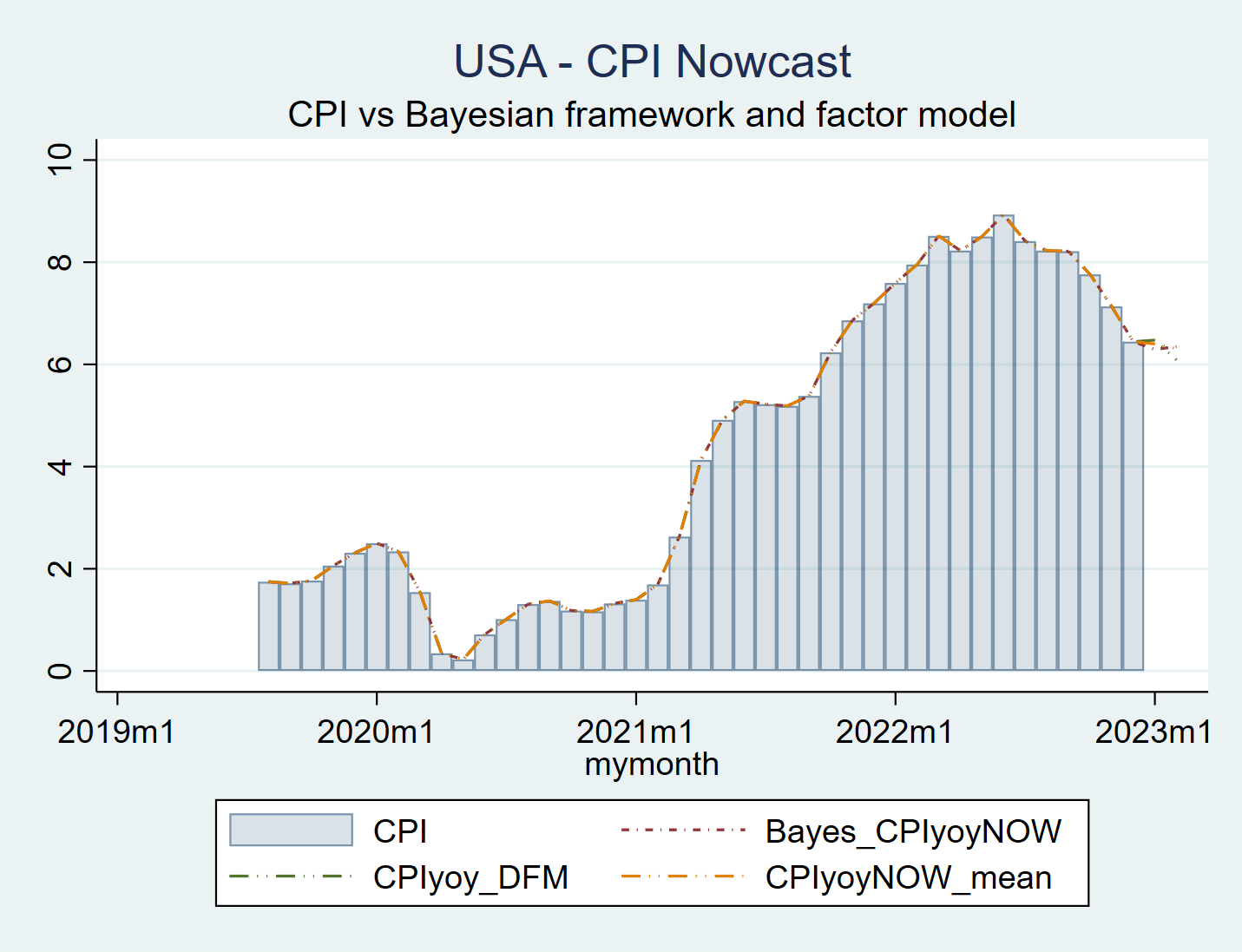

US Nowcast for CPI with monthly data

The Nowcast for the US CPI did not move pretty much in the last weeks. The current estimates are at 6,08% for the DFM model and for the bayesian model mean = 6,29% (lower = 5,80%, upper = 6,78%). None of my approaches/models show an increase in inflation. Consensus estimate is currently at 6,2%, which is in line with the model estimates below.

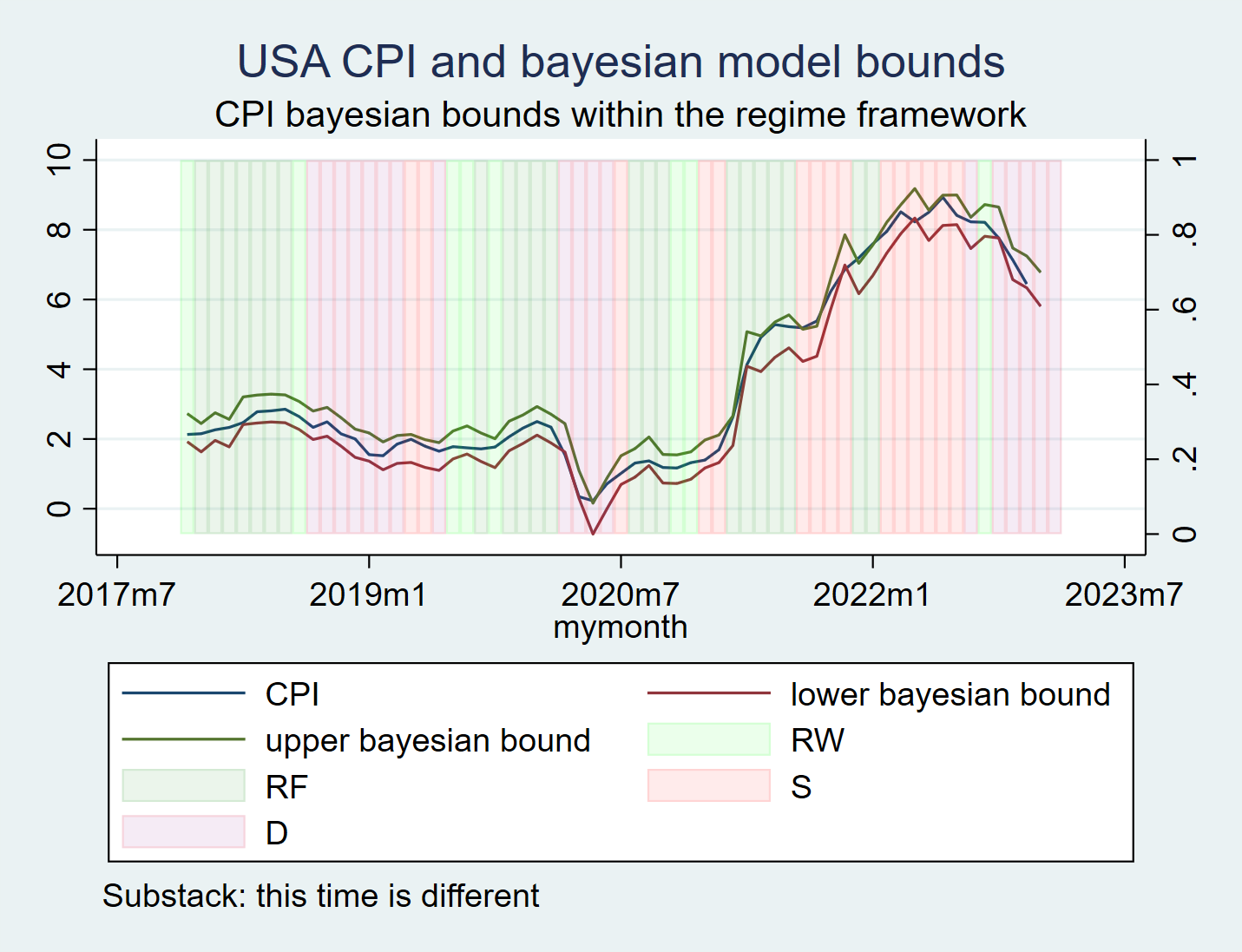

The bayesian model for the CPI

In the figure below, you can see the Bayesian simulation with the macro data. It is interesting to note that the consumer price index tends to move toward the lower bound when the market regime is disinflation (monthly data). Given the disinflation narrative, the lower bound seems increasingly likely.

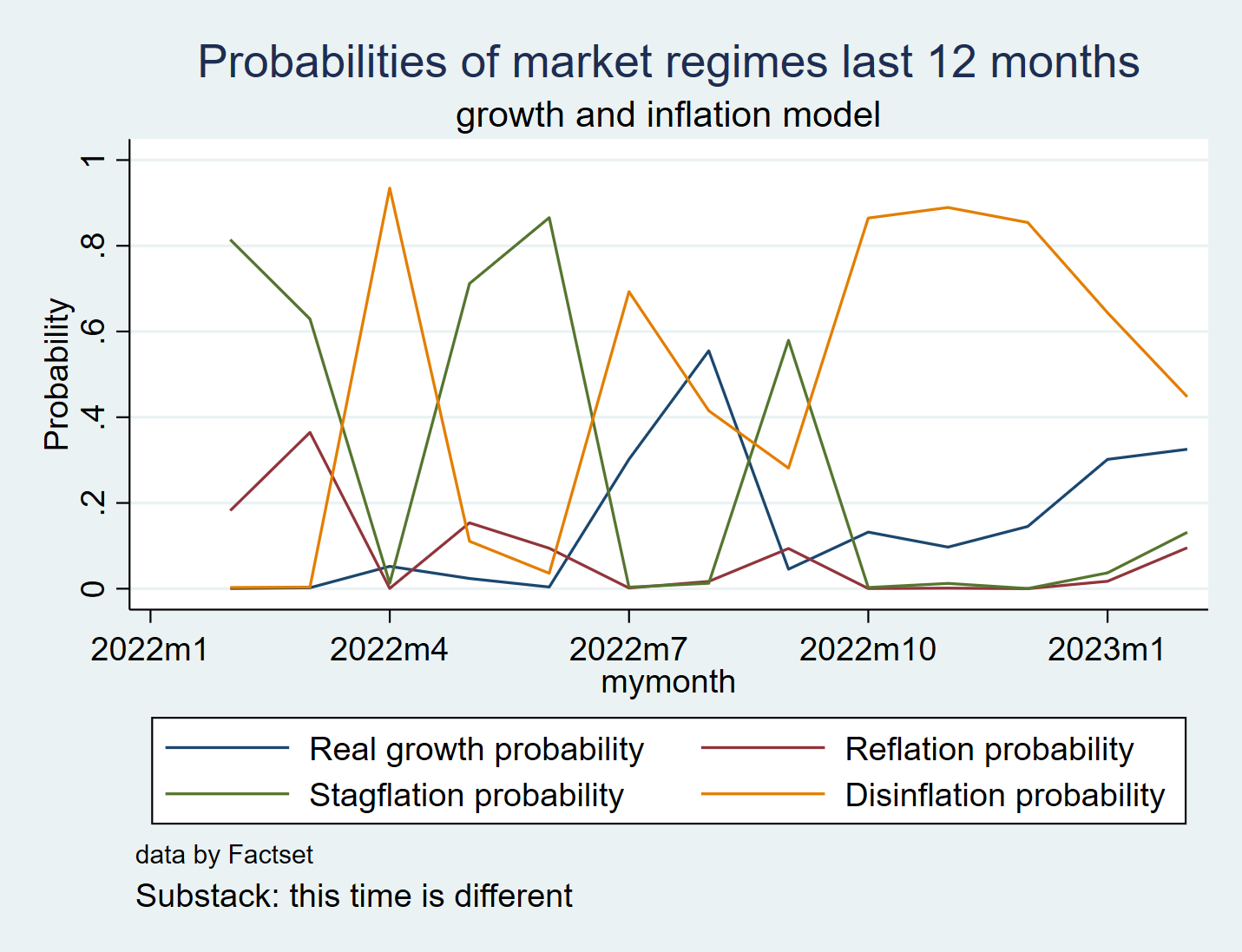

Market regime probabilities based on monthly data

The nowcast implied probabilities for the regime continue to show disinflation as the prevailing output. However, recent data changes show an increase in growth probabilities, reflecting some better-than-expected data.

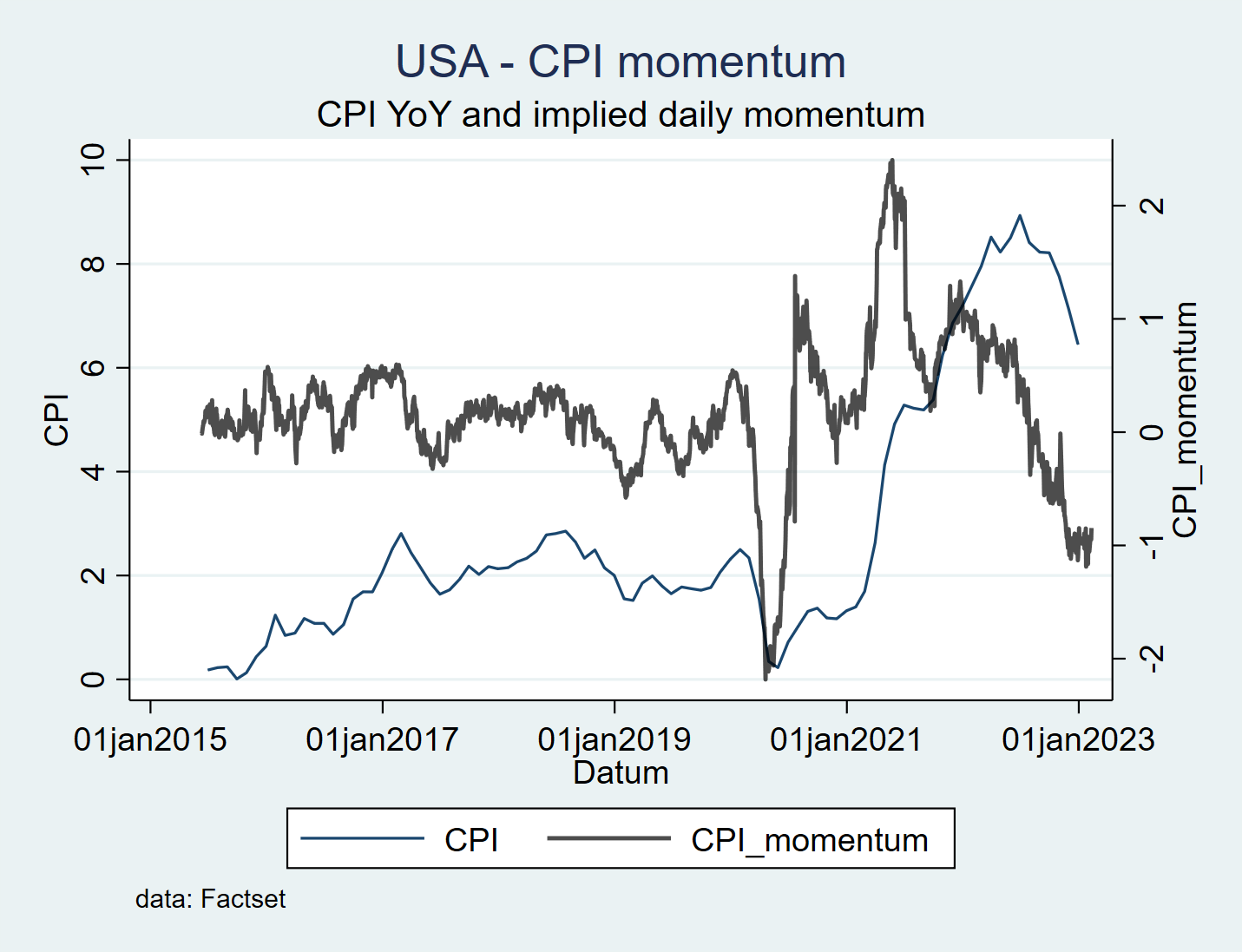

US Nowcast for CPI - market implied

The market-implicit measure is based on the macro signal strength method I report on substack. It uses daily/weekly data and a machine learning framework to extract as much data as possible.

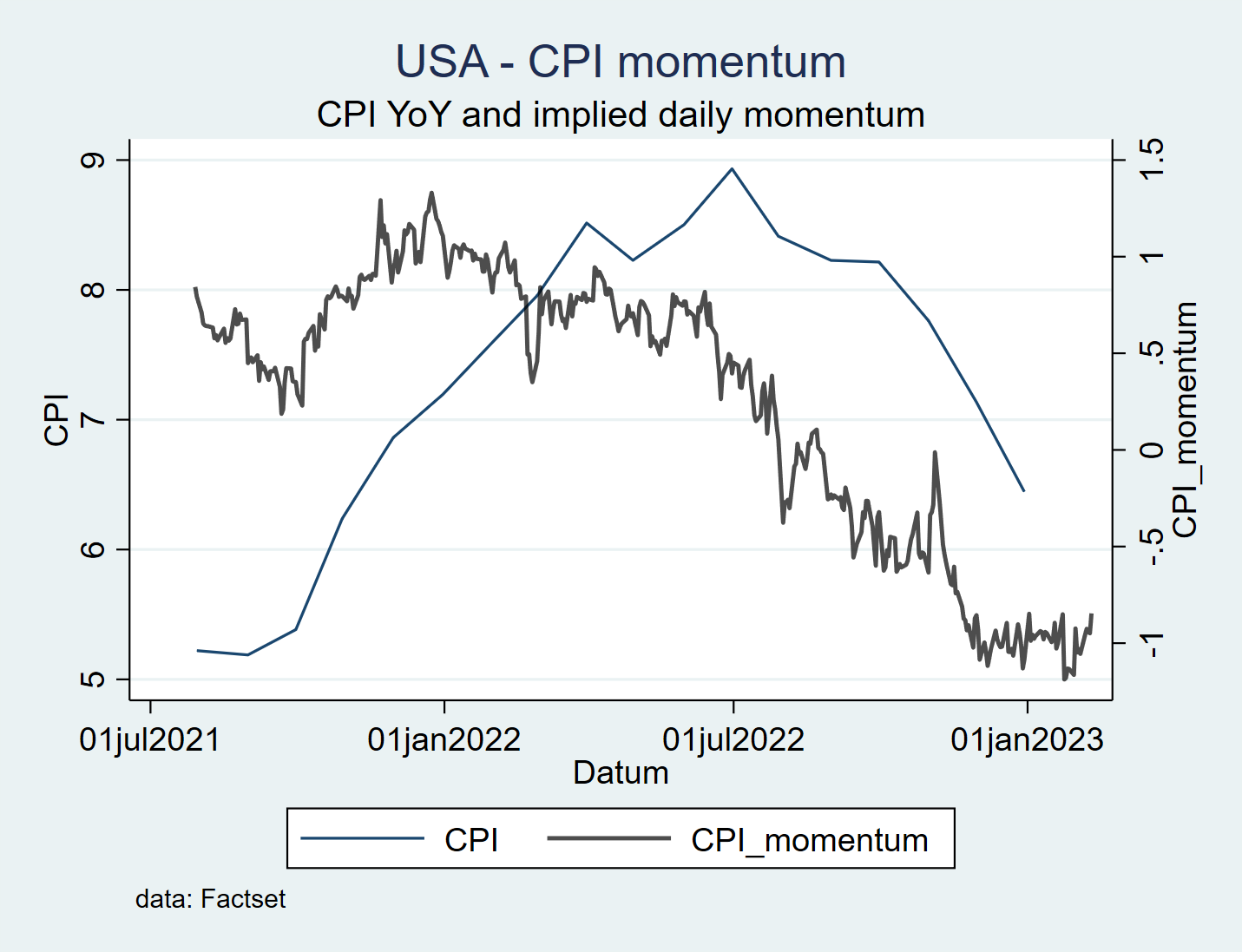

In the figure below, you can see the CPI annual growth rate and CPI momentum on a 3-month trend basis (3-month difference in growth rate). The CPI momentum is falling quite sharply, indicating a lower value. The current momentum value is -0.9% to -1.2%.

Latest daily CPI momentum

Yearly coupon:

monthly coupon:

Keep reading with a 7-day free trial

Subscribe to This Time is Different to keep reading this post and get 7 days of free access to the full post archives.