Weekly roundup #16

Forward Return Analysis & macro data roundup

This Content is intended for educational purposes only. No portion of this Content purports to be, individualized or specific investment advice and is not created to provide investment advice to individuals. All information provided is impersonal, general in nature and is made without regard to individual levels of sophistication or investment experience, investment preferences, objectives or risk parameters and without regard to the suitability of the Content for individuals or entities who may access it. No information found on this Newsletter, nor any Services provided, should be construed as an offer to sell, or a solicitation of an offer to buy any security or investment vehicle, nor should it be construed as tailored or specific to you, or any reader or consumer thereof. You understand and agree that this Content does not constitute specific recommendations of any particular investment, security, portfolio, transaction or strategy, nor does it recommend any specific course of action is suitable for any specific person or entity or group of persons or entities.

This is a new weekly series where you will get a number of indices and ETFs analyzed using the "Recognizing Market Chaos" framework. I will highlight the best opportunities based on the overviews and include the image in the blog post. This is the first post for the new theme, so I need a little more time to adjust the content and find the right way to deliver the most value.

For an introduction, see the posts on recognizing chaos in the market.

Recognizing the chaos in the markets #2

This Content is intended for educational purposes only. No portion of this Content purports to be, individualized or specific investment advice and is not created to provide investment advice to individuals. All information provided is impersonal, general in nature and is made without regard to individual levels of sophistication or investment experience, investment preferences, objectives or risk parameters and without regard to the suitability of the Content for individuals or entities who may access it. No information found on this Newsletter, nor any Services provided, should be construed as an offer to sell, or a solicitation of an offer to buy any security or investment vehicle, nor should it be construed as tailored or specific to you, or any reader or consumer thereof. You understand and agree that this Content does not constitute specific recommendations of any particular investment, security, portfolio, transaction or strategy, nor does it recommend any specific course of action is suitable for any specific person or entity or group of persons or entities

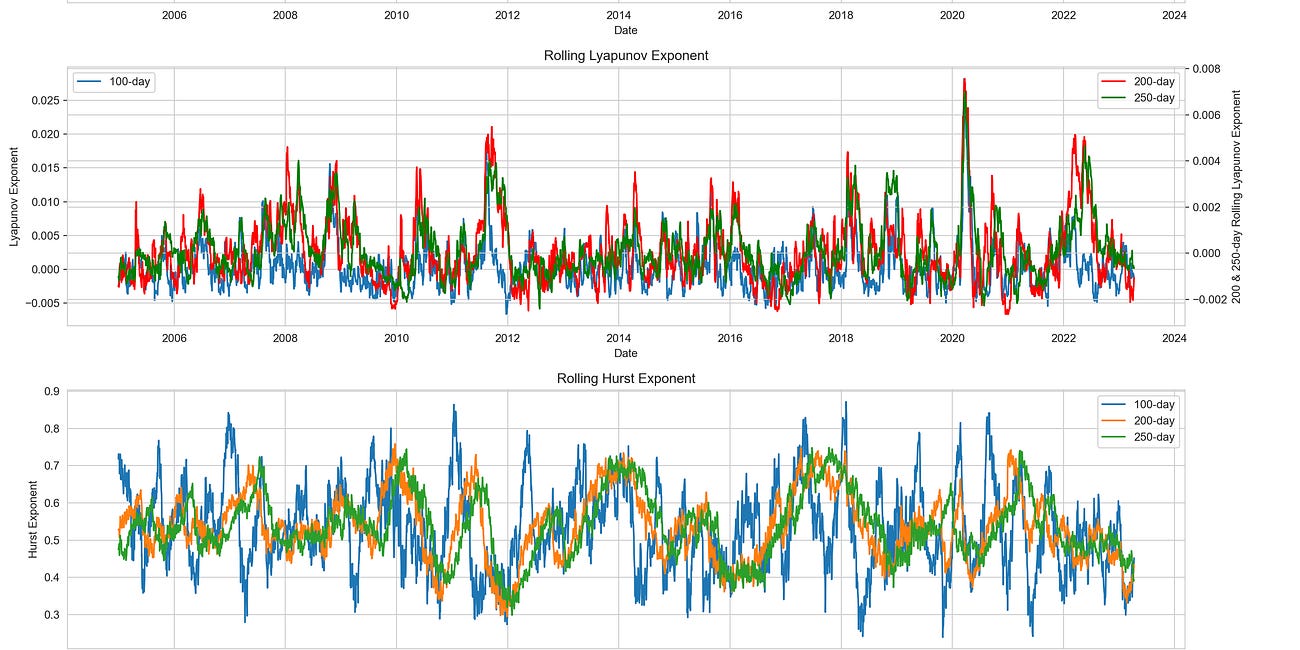

I made some other changes and improvements to the model. I added a likely estimate of upside momentum in forward returns (gray line). This is another layer to assess whether the forward returns structure is supported by all possible estimates. Then I added a volatility analysis to the model, shown in another image. This feature added another 3-8% of validity to the model (depending on the asset). Also the overview now contains a signal strength column, which shows the relationship of the bullish probability and quantile prints ranging from 0 to 4, where 4 is the highest signal strength.

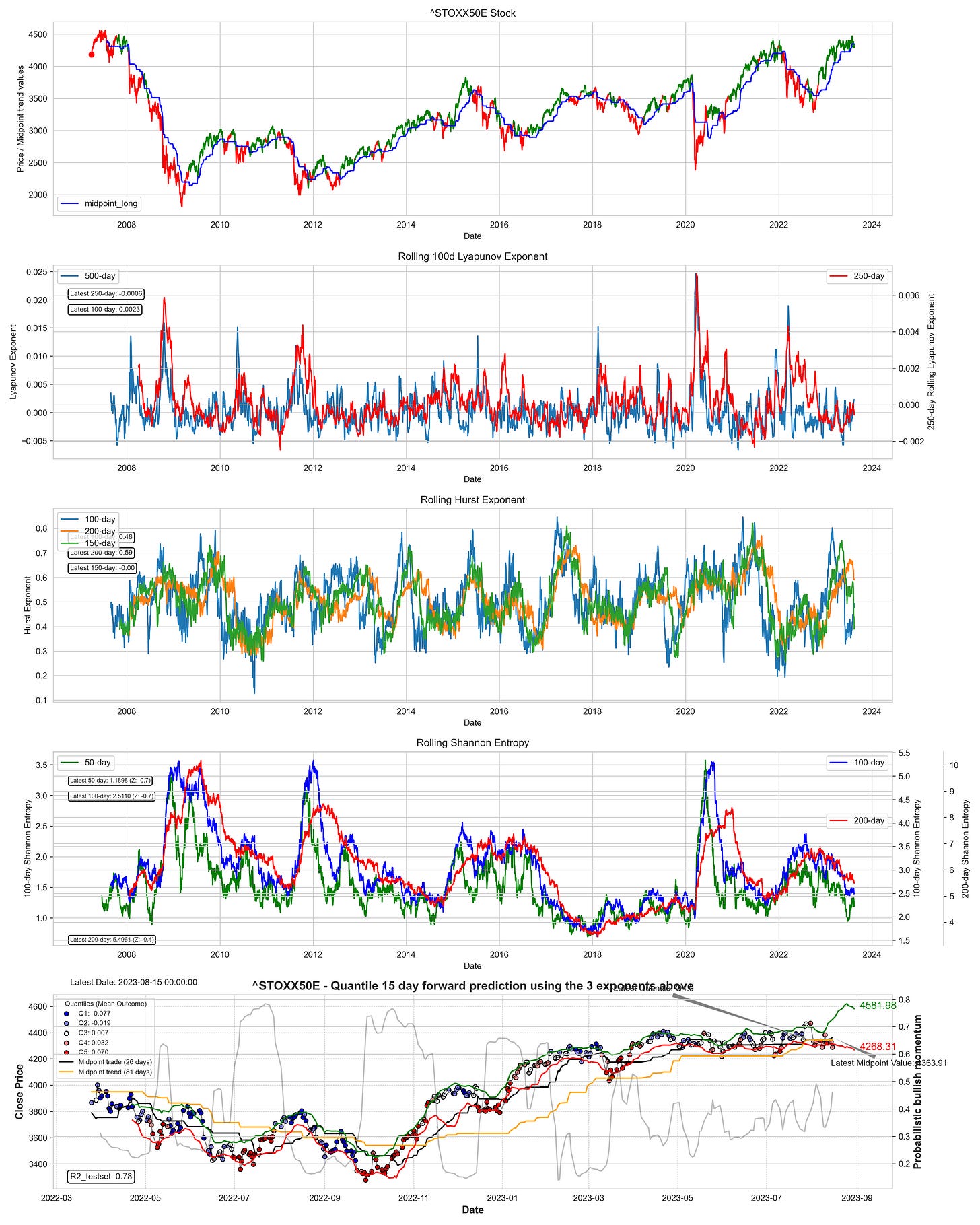

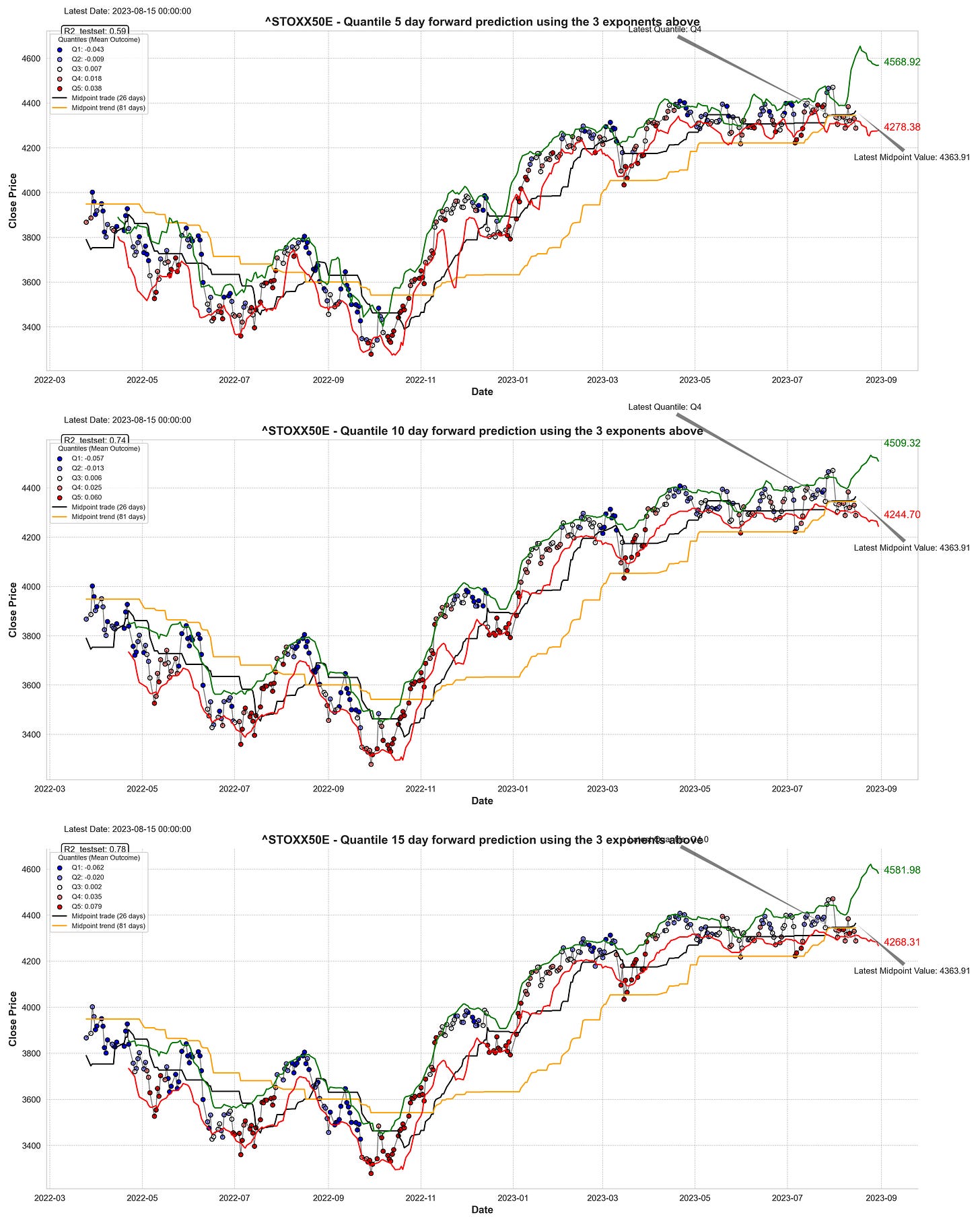

Another update to the model, resulting in another 5% improvement in the prediction of the return. I also split the momentum indicator into two parts, a trading part that optimizes between 5 and 30 days, and a trend part that optimizes between 63 and 126 days. The first subplot now shows the momentum indicator as a color code for the price index. Green is bullish and red is bearish.

Another addition is the forward return model for two more time frames, the 5-day forward return and the 10-day forward return. In the upper left corner you can see the r-square for the validity of the model.

Index overview

Most indices are in an uptrend, with only two exceptions: VIX and IPSA. In the U.S., S&P500, Dow Jones, NASDAQ and Russell 2000 are all in an uptrend. However, the term return structure determined by the quantiles indicates a weak term return structure (negative 15-day term returns). The Dow Jones has the lowest signal strength, followed by the NASDAQ and the S&P500. For the VIX, we see a downtrend and a mixed forward return structure that could mean some swings but nothing in the sustained spectrum.

For LONG exposure, the STOXX50 provides the best signal with multiple quantile 4 prints and the highest signal strength among the various indices. On the STOXX50, we see the short-term hurst action moving into the mean revesion range, and the various forecast windows point to the same outcome - higher returns over the next 5 to 15 days.

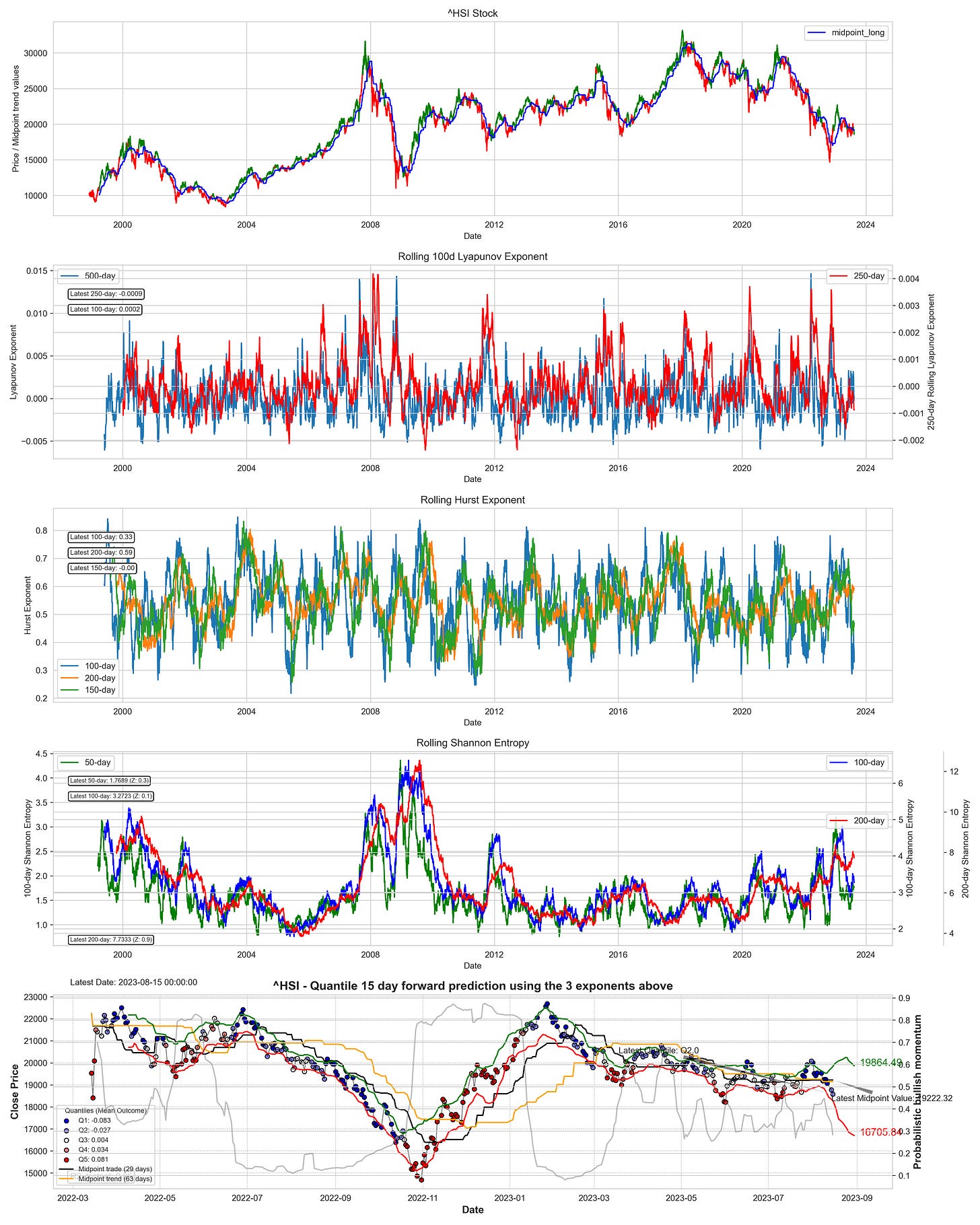

On the short side, it is a continuation of the HSI short. The index is still showing poor return forecasts and weak signal strength. HSI is currently in an uptrend (only 1-2 days), but the signal will turn back to a downtrend as the midpoints are very close.

LONG:

New: 3 different time frames for the forward return model

SHORTS:

Last weeks return (5 days:)

Long:

NIKKEI (N225) -1,22%

Short:

HSI -5,27%

Yearly coupon:

monthly coupon:

Keep reading with a 7-day free trial

Subscribe to This Time is Different to keep reading this post and get 7 days of free access to the full post archives.